What is DeFi in Crypto: the Ultimate Guide

In the brave new world of cryptocurrencies, go-getters take a chance on DeFi more and more often. From this overview, you’ll learn everything you need to know either you’re new to the sector or not. All the technicalities about MakerDAO, Uniswap’s liquidity pools, exotic DeFi tokens are all there. Just open our guide and learn why DeFi is so popular. Is it a fad or a secular trend? How can you earn money while leveraging with such platforms as Curve Finance? And, finally, isn’t it too late?

What is DeFi?

Decentralized Finance (DeFi for short) is a lot of things but one simple definition. DeFi in crypto might mean several things. First of all, it’s a community of libertarian-minded developers and startupers who aim to replace traditional banking with new distributed algorithms.

Why? This will help eliminate the problem of trust, excessive fees as well as single points of failure and control – issues common for the long-established financial sector.

Second, DeFi is a nickname for a wide ecosystem of dApps for borrowing/lending, monetary banking, staking, trading and so much more – built mostly on top of Ethereum and sometimes on other blockchains such as TRON or EOS.

And last but not least, it’s a movement with its leaders, crystal-clear logic, and philosophy. Here it goes.

Crypto DeFi projects are interoperable for all dApps to be woven together on a technical level. They are accessible to anyone with an Internet connection: every developer can fork your code, every person on Earth can sign up with your app. All the market-level information, say, the history of your crypto transactions, is transparent to all participants, although nobody knows (except for forensics maybe) that this history is yours.

At the end of this summer, for the first time ever, DEXes (decentralized exchanges) built on Ethereum set three consecutive records, aggregating a volume of $11.6 billion in a matter of just one month, up from $4.5 billion in July. But this game has not always been that big.

So, what is a DeFi crypto project and where, actually, has everything begun?

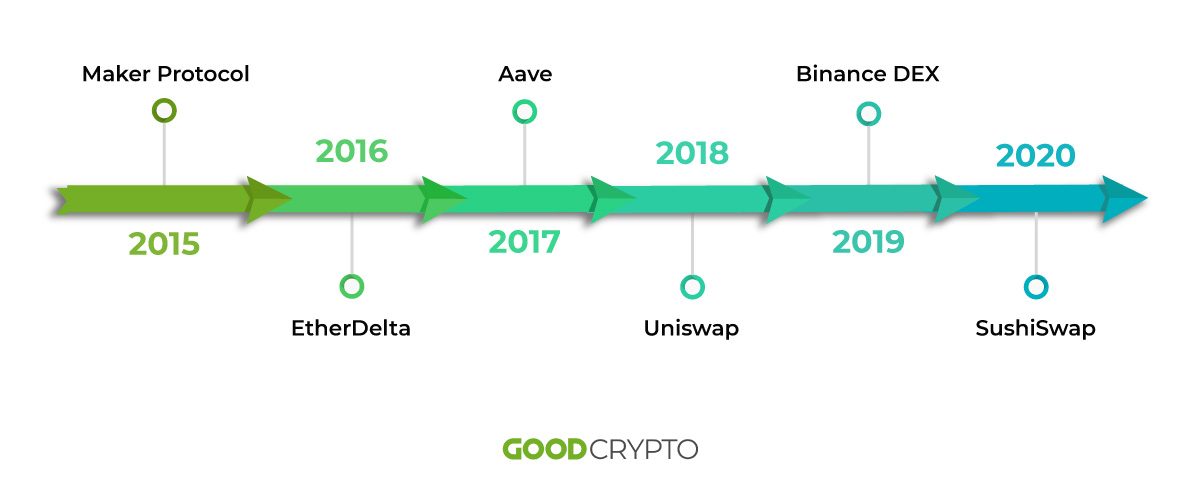

A brief history of DeFi projects

Everything started with Satoshi in 2008 when he pitched his whitepaper to the cypherpunks on the mailing list he was subscribed to. Bitcoin was the very first crypto DeFi project.

Still not convinced? OK.

Everything started with Vitalik in 2013. In the very first version of the Ethereum whitepaper, he described three categories of possible applications on his blockchain: financial, semi-financial, and non-financial. Buterin envisioned much of what we see playing out right now: derivatives, prediction markets, lending…

Still not convinced?

In May 2018, Polychain offices in San Francisco hosted a meetup where 150 visitors proclaimed their projects to be DeFi projects – Maker Foundation, Compound Labs, 0x, Wyre, dYdX were there – early dApps focused on monetary economics. But not everybody has attended.

So, again, where does it leave us? What is DeFi in crypto? Take a look!

Maker Protocol – a collateral-backed stablecoin (est. 2015)

Maker Foundation, today you might know it as MakerDAO, came into existence 5 years ago.

As of now, it has bottled up some dark algorithmic magic inside of its stablecoin, Dai, for it (almost) always to be equal to $1. But it’s not everything the protocol can do.

DeFi crypto loans are one of the other famous features of the platform.

Put your Ether into a smart contract, generate some Dai, borrow it, repay 0,5% per-year interest, and get your Ether back. Lost in translation? What sounds too complicated didn’t stop DeFi kids from locking $2.6 billion in the protocol’s smart contracts, as of this writing.

In such a competitive ecosystem as crypto DeFi is, it’s no wonder that after Maker had emerged, other akin projects started to pop up, too.

Lending, being a fundamental part of traditional finance, has seen a DeFi crypto frenzy this year, with the record inflow of more than $6 billion. That being said, in the crypto niche, there was seemingly a pressing demand to migrate the elements of well-established banking to the blockchain, which DeFi has done.

EtherDelta – the first decentralized exchange (est. 2016)

One of the first decentralized exchanges (and of the first DeFi crypto projects) was EtherDelta, the trading platform that relies on smart contracts to automatically execute trades. No middlemen, no centralized governance – just smart contracts executing orders.

If you buy and sell on top of this exchange, you don’t need an account with it, just MetaMask in order to send and receive ERC20 tokens.

However, in 2020, EtherDelta’s order book processing, such as executing, modifying, and canceling the order, looks slow. Because everything happens on Ethereum’s mainchain you have to spend gas whenever creating, modifying, and canceling orders.

That being said, the era of EtherDelta is rumored to have come to an end due to low trading volume and market liquidity. However, such DeFi platforms as 0x have tried to address the above issues.

0x – when a DEX meets a centralized exchange (est. 2016)

Another pioneering DEX out there, 0x, with its $27-million 24h trading volume, these days is not among top dogs in DeFi. However, the founders of this exchange described an interesting Automated Market Maker (AMM) model in their whitepaper that very few people noticed at the time.

Automated Market Making effectively replaces a traditional order book with a system where anyone can add crypto assets to the liquidity pool and those assets can be automatically swapped against the pool’s latest price that is set by a predefined formula.

Whenever you add liquidity to a pool, you earn fees for any trade facilitated by that pool. Thus, people earn fees for providing pool liquidity, and seemingly they like it a lot since it has created these surreal monthly volumes on top of not only Uniswap but also Curve and Balancer. But everything started on 0x.

Back at the time, the engine under the hood of this exchange looked very impressive not only because it offered the AMM functionality but also because it offered off-chain transactions, which significantly lowered trading fees, processing time and in theory could compete with such market players as Coinbase.

Aave – DeFi lending platform (est. 2017)

In 2017, Stani Kulechov founded ETHLend, a peer-to-peer exchange now rebranded as Aave, where you can lend and borrow a wide range of crypto, including DAI, USDC, TUSD, USDT, sUSD, BUSD, ETH, BAT, etc.

With Aave, lenders deposit their funds into a pool from which users borrow. While borrowing, you will need to pledge collateral that is larger than your DeFi loan (very typical for DeFi) and pay either stable or algorithmically based variable interest fees. While lending or depositing collateral, you’d be given aTokens that will allow you to earn interest.

The Aave pools also reserve a small percentage of the assets to hedge against volatility within the protocol and allow lenders to withdraw at any time.

Along with other DeFi lending, this protocol grew tremendously by the end of the summer 2020 and even gained first place in DeFi-protocol rankings surpassing Compound and MakerDAO in terms of total value locked (TVL). It currently has over $1 billion TVL.

Binance DEX – (de)centralized? (est. 2019)

But wait, you should say right now. All those DEXes are great, but what about the industry whale, Binance? Its $25-billion 24h trading volume surpasses all the records set by other exchanges over months.

Binance had jumped on the DeFi bandwagon early on, launching Binance DEX in 2019. At the time it looked like a clever move by CZ – if DEXes truly took off and became a threat to the centralized exchanges, Binance would be at the forefront with its DEX. True, it’s better to disrupt yourself than to get disrupted by someone else.

So they’ve developed a new blockchain for its decentralized exchange, which boasted low latency, high throughput, and low fees in sharp contrast to Ethereum. Later they’ve migrated their BNB token from the ERC20 standard on Ethereum to Binance Chain and had even acquired Trust Wallet in a bid to jumpstart the Binance Chain ecosystem and, most probably, to try and challenge Ethereum.

Binance DEX started with a $1.2-million 24h trading volume which was an impressive number for a 2019 DEX, pushed the likes of Huobi, OKEx, and Bithumb to work on their own DEXes and for a moment it looked like CZ might actually pull it off. However, Binance DEX 24h volume is slightly more than $645K, as of this writing, and the DeFi ‘revolution’ is happening on Ethereum. Whether it’s due to the technical superiority of the Ethereum’s Virtual Machine or the fact that no one really perceived Binance Chain as independent and decentralized remains anyone’s guess.

No comments